Bhopal police recently saved a local man from a six-hour ‘digital arrest,’ thwarting a multi-crore scam in progress. The man, whose identity remains confidential for security reasons, was held captive through a series of digital manipulation tactics and intimidation attempts by cybercriminals who targeted him in an elaborate online scam. The police’s timely intervention not only protected the victim from losing his life savings but also highlighted the growing sophistication of cyber scams in India.

The Unfolding of the Scam

The victim, a resident of Bhopal, first received a call from an unknown number claiming to be from a reputable financial institution. The caller informed him of an “urgent issue” with his bank account and insisted on immediate action to prevent a serious financial loss. The call was professional and convincing, luring the victim into believing it was legitimate. Soon, he was directed to download a remote-access application, allegedly to help him resolve the problem. This application, however, enabled the scammers to gain control of his mobile device and personal information, effectively putting him under ‘digital arrest.’

Once the scammers had control, they began initiating transactions from his bank account, demanding that he comply with their instructions. For six hours, the man remained under their control, unable to disconnect the call or access his accounts as he was bombarded with threats and coerced into transferring funds. The scammers repeatedly manipulated him, exploiting his fear of financial loss and even legal repercussions, which they falsely claimed could result if he did not follow their instructions.

Police Involvement and Rescue Operation

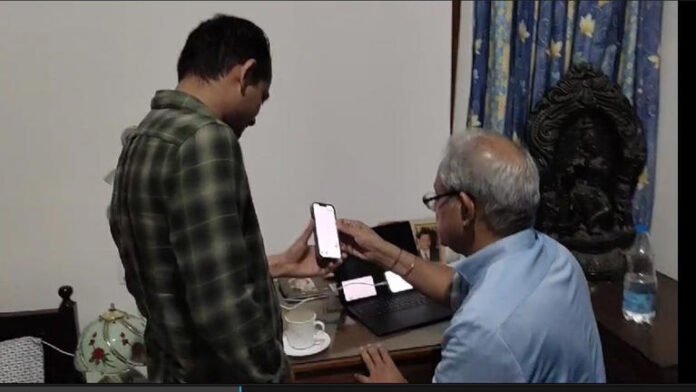

Fortunately, the victim’s family noticed something was amiss when he isolated himself with his phone and displayed signs of distress. His wife and son, sensing that he might be in danger, reached out to the local police, explaining the unusual behavior. Acting promptly, the cybercrime unit of Bhopal police sprang into action, assessing the situation and guiding the family on how to intervene.

With help from cybersecurity experts, the police instructed the family to forcibly disconnect the internet connection in their house, severing the scammers’ control over the victim’s device. Once the phone’s connectivity was cut off, the victim was finally able to regain access to his device and speak freely, ending the six-hour ordeal. Officers quickly assessed his accounts and froze them temporarily to prevent any additional unauthorized transactions.

Inside the Scam: How ‘Digital Arrests’ Work

The concept of a ‘digital arrest’ is relatively new in the world of cybercrime and involves holding a victim hostage by controlling their digital devices through fear and manipulation. The scam, often orchestrated by international crime syndicates, exploits remote access software to restrict victims from acting independently. Scammers then use psychological tactics to maintain control over their targets for hours, draining their bank accounts and gathering sensitive information in the process.

The police explained that this scam was part of a larger trend where criminals exploit fear and urgency to trap individuals into a ‘digital prison.’ Once under control, victims are coerced into transferring funds, sharing sensitive data, or unknowingly allowing criminals to conduct fraudulent transactions. Victims often hesitate to reach out for help due to the convincing threats issued by scammers, who warn them of severe financial or legal repercussions.

A Growing Problem: The Rise of Cyber Scams in India

Cybercrime in India has witnessed a significant increase in recent years, with scams becoming more sophisticated and diverse. Scammers now utilize a range of digital tools, from fake banking apps to phishing emails and remote access software. According to cybersecurity experts, criminals exploit the rise of digital banking and mobile transactions, particularly among individuals who may not be fully aware of cybersecurity best practices. The COVID-19 pandemic accelerated digital adoption, making more people vulnerable to online scams as they increasingly rely on digital platforms for financial transactions.

The Bhopal incident is a reminder of how cybercrime has evolved to include psychological manipulation alongside technical tactics. The complexity of such scams necessitates constant vigilance from users and proactive intervention from law enforcement agencies.

Police Advisory: How to Stay Safe

Following the incident, the Bhopal police issued an advisory to the public on protecting themselves from similar scams. Key recommendations included:

- Avoid downloading unknown applications – especially those granting remote access to your device, unless verified and necessary.

- Do not respond to unsolicited calls from ‘banks’ or financial services asking for personal information or urging immediate action.

- Contact your bank directly through official numbers if you receive a suspicious call about your accounts.

- Educate family members about the risks of cybercrime and ensure that they know basic cybersecurity protocols.

- Report suspicious activity immediately to local authorities or the National Cyber Crime Reporting Portal.

A Timely Warning and Call for Cyber Awareness

The Bhopal police’s successful intervention in this case is a testament to the importance of community vigilance, prompt reporting, and effective law enforcement collaboration in combating cybercrime. This ‘digital arrest’ incident underscores the need for public awareness regarding cyber fraud techniques and reinforces the role of police in safeguarding citizens from modern threats. The public is reminded to stay alert and proactive in protecting their digital security as cybercrime methods continue to evolve.