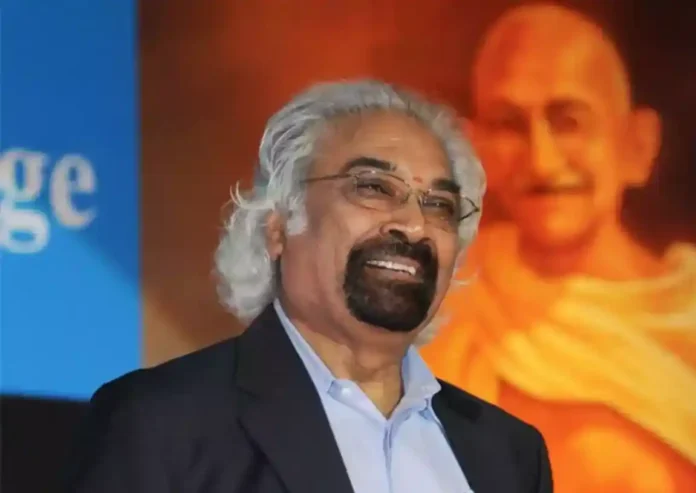

Recently, Sam Pitroda, a renowned technocrat and policy advisor, stirred the pot by advocating for the reintroduction of inheritance tax in India. His remarks have reignited discussions about wealth distribution, fiscal policy, and social equity. As the discourse unfolds, it is imperative to examine Pitroda’s proposal in the context of India’s socio-economic landscape and compare it with the status of inheritance tax in other countries.

Sam Pitroda’s call for the reintroduction of inheritance tax in India has sparked a flurry of reactions from various quarters. Proponents argue that such a tax would promote greater economic equality by redistributing wealth and curbing intergenerational accumulation of riches. They contend that inherited wealth perpetuates inequality and hampers social mobility, undermining the principles of meritocracy and fairness. Moreover, proponents assert that inheritance tax could serve as a significant source of revenue for funding social welfare programs and infrastructure development, thereby fostering inclusive growth.

However, opponents of inheritance tax raise valid concerns about its potential impact on entrepreneurship, investment, and capital formation. They argue that taxing inherited wealth disincentivizes savings and investment, stifling economic growth and innovation. Moreover, critics contend that inheritance tax could lead to capital flight as affluent individuals seek to shield their assets from taxation through various loopholes and offshore investments. Additionally, opponents question the practicality and feasibility of implementing inheritance tax in a country like India, where tax evasion and avoidance are widespread due to administrative inefficiencies and corruption.

To gain a deeper understanding of the issue, it is instructive to examine the status of inheritance tax in other countries. Several developed nations, including the United States, United Kingdom, and various European countries, levy inheritance or estate taxes on the transfer of wealth from deceased individuals to their heirs. These taxes are typically progressive, with rates varying based on the value of the inherited assets and the relationship between the deceased and the beneficiary.

In the United States, for example, inheritance tax applies to estates valued above a certain threshold, with rates ranging from 18% to 40% depending on the value of the estate. However, the federal government has raised the exemption threshold in recent years, significantly reducing the number of estates subject to taxation. Similarly, in the United Kingdom, inheritance tax is levied on estates exceeding a certain threshold, with rates ranging from 0% to 40% depending on the value of the estate and the relationship between the deceased and the beneficiary.

In contrast, several countries, including Canada, Australia, and New Zealand, do not impose inheritance tax at the federal level. Instead, they rely on other forms of taxation, such as capital gains tax, to generate revenue from the transfer of wealth. However, some provinces in Canada levy probate fees or estate administration taxes on the probate of wills, which serve a similar purpose to inheritance tax.

The status of inheritance tax in India is a subject of considerable interest and speculation. India did have an estate duty, which was abolished in 1985 by the then-Finance Minister, V.P. Singh. Since then, the idea of reintroducing inheritance tax has been periodically debated but has not materialized into concrete action. The absence of inheritance tax in India is often attributed to concerns about administrative complexity, tax evasion, and its potential impact on investment and entrepreneurship.

In addition, Sam Pitroda’s advocacy for the reintroduction of inheritance tax in India has reignited discussions about wealth redistribution, social equity, and fiscal policy. While proponents argue that inheritance tax is necessary to address growing wealth inequality and fund social welfare programs, opponents raise concerns about its impact on economic growth, investment, and capital formation. By examining the status of inheritance tax in other countries, we can glean insights into its potential benefits and challenges and inform policy decisions that strike a balance between equity and economic efficiency. As India grapples with the complexities of taxation and wealth distribution, the debate over inheritance tax is likely to remain a contentious issue on the national agenda.