Amazon magnate Jeff Bezos revealed his decision to relocate from Seattle to Miami, citing the desire to be in closer proximity to his parents. Bezos and his fiancé, Lauren Sanchez, reportedly secured two properties in Indian Creek, Florida, signaling a significant shift in their residency and lifestyle.

Jeff Bezos’ Move to Miami: Family Proximity and Tax Implications

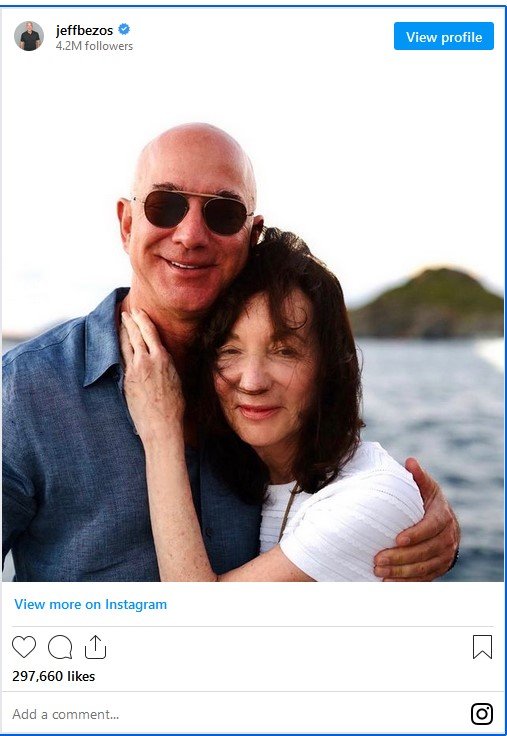

Expressing his intentions on Instagram, Bezos shared a nostalgic video captured by his father, Miguel Bezos, depicting Jeff in his inaugural office. The caption reflected Bezos’ fondness for Miami, the place where he spent his formative years. His decision to be near his parents, paired with his admiration for Miami, became the central theme of his announcement.

The gesture of relocating to be nearer to his elderly parents holds a sincere and thoughtful aspect. It’s a familiar situation for many individuals in what is often referred to as the “sandwich generation,” juggling responsibilities between caring for both their children and their aging parents. With Jeff Bezos having four children from his past marriage to McKenzie Scott, this transition from the familiar environment of Seattle to support his parents in their later years must have presented a challenging decision for him.

It appears that the motivation behind Bezos’ move is being portrayed as primarily driven by his profound love and commitment as a son (prompting a query about contacting his mother). However, the insinuation made here is that this relocation from Washington to Florida might, coincidentally, offer substantial tax savings, unrelated to his affectionate motivations.

Jeff Bezos’s purchase of homes in Indian Creek, known as the “Billionaire Bunker,” swiftly garnered attention, sparking contrasting opinions about his motives. While his commitment to being near his parents was commendable, some speculated on potential financial motivations. Moving from Seattle to Florida could result in substantial tax savings for the billionaire entrepreneur.

The intricacies of taxes have played a role in Jeff Bezos’s past decisions. Notably, the state of Washington’s small population was an influential factor in his choice to establish Amazon in Seattle initially. The avoidance of establishing sales tax “nexus” and strategic warehouse placements was pivotal in Amazon’s growth strategy in its earlier years.

Recent changes in Washington state’s capital gains tax, prompting a 7% levy, might have influenced Bezos’s decision. With the majority of his wealth tied to Amazon stock, the prospect of saving millions in capital gains tax could be a significant factor behind his relocation to Miami, which lacks capital gains tax and is perceived as a tax-friendly region.

The potential tax savings stemming from Bezos’s stock sales in a state like Washington, where taxes on substantial capital gains apply, could substantially impact his financial obligations. Considering his vast holdings and a conservative estimation of his Amazon stock value, the financial implications of such a move might be substantial, possibly amounting to billions of dollars.

Bezos’s choice to relocate, despite personal reasons, invites speculation regarding the significant financial advantages that a tax-friendly state like Florida might offer to high-net-worth individuals. Such tax considerations, especially concerning capital gains, often drive strategic decisions among tech billionaires, including Bezos.

The incorporation of tax implications and family proximity in the decision-making process underscores the multifaceted reasoning behind Bezos’s choice to move, illustrating the complex interplay between personal and financial motives in major life decisions.